By MATTHEW HOLT

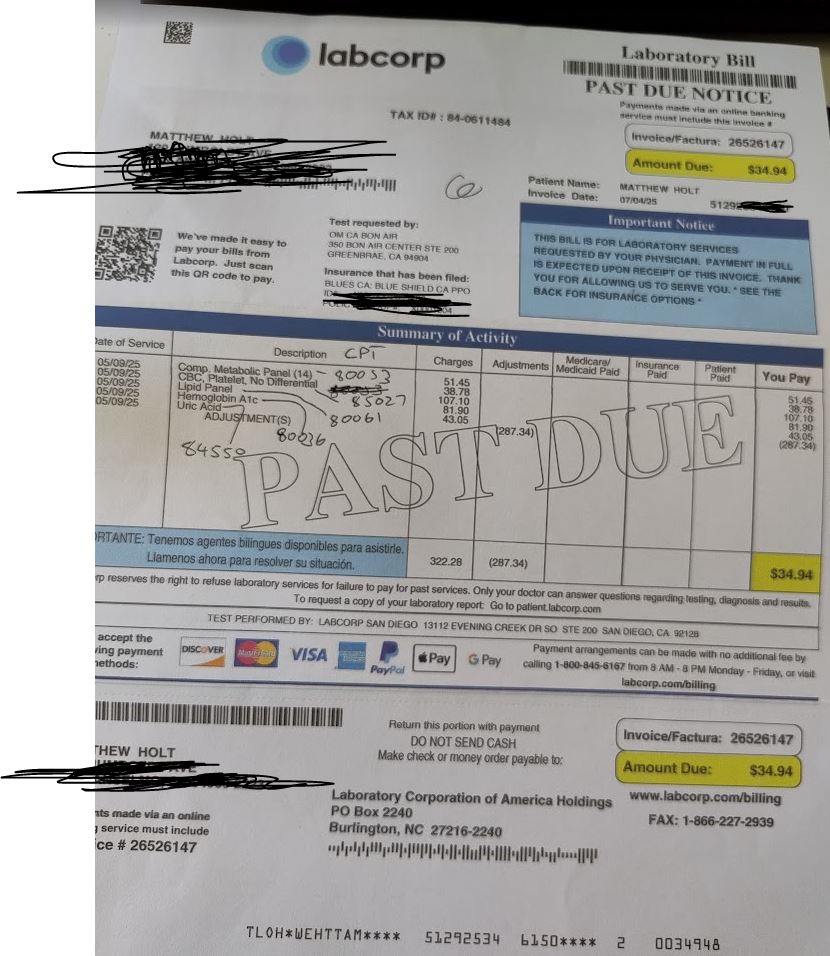

I know you all care, so I am giving a 6th update on the telenovela about my Labcorp bill for $34.95.

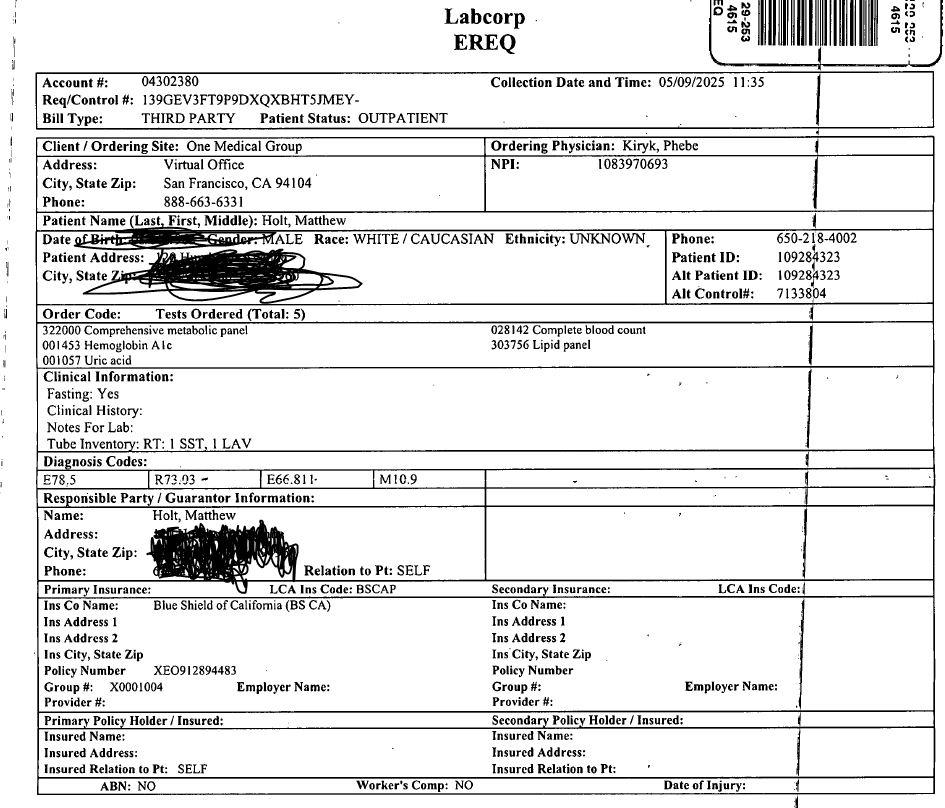

The very TL:DR summary of where we are so far is that in May 2025 I had a lab test to go with the free preventative visit that the ACA guarantees, but I was charged for the lab tests and I was trying to find out why, because according to CMS I should not have been.

For those of you who have missed it so far the entire 5 part series is on The Health Care Blog (1, 2, 3, 4 & 5). Feel free to back and read up.

When we left the scene on Sept 9, Blue Shield of California had finished their 30 day investigation and their rep read me the letter they sent me (that I couldn’t open due to their secure email not working). The letter told me that Brown & Toland Physicians, the IPA that manages my HMO, was going to investigate. Today I got a text from Blue Shield alerting me to a secure email and I got all excited, but it was nothing to do with this. And of course I should have heard from Brown and Toland in October or November.

So I decide to pick it all up again, and I called Brown & Toland Physicians or actually Altais which is the holding company that owns them and Blue Shield. I got through the phone tree and eventually got, “leave your number and get a call back” which actually happened not too long later.

The very nice rep tried to figure out my case and told me this:

On 8/14/2025 Mike at Blue Shield called Brown and Toland and asked for the original claim to be reviewed (1430201). I am pretty sure Mike is the nice man from the Executive Admin office at Blue Shield we met in part 2 (or was it part 3?).

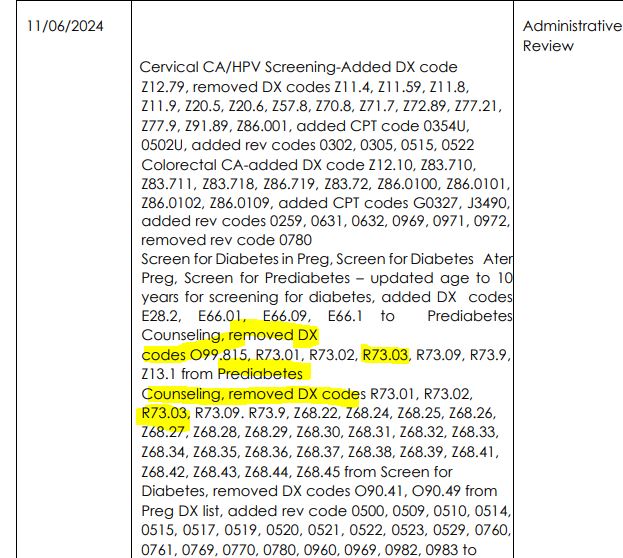

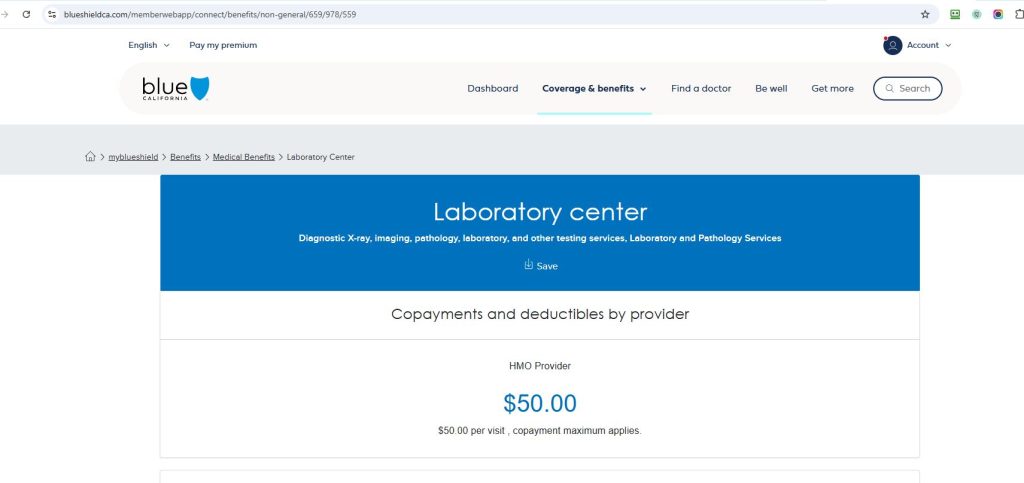

On 8/29/2025 the benefits department at Brown and Toland finished their review and reported that the original lab test wasn’t coded as preventative lab services by One Medical, so that the co-pay of $34.95 was correct. ($34.95 was the total agreed payment for all the tests, charged at a total of $322.28. And as it was less than my $50 copay, LabCorp only charges the patient for the total, not the $50!)

Meanwhile, that 30 day Blue Shield investigation was still going on. It ended up with them asking Brown and Toland to investigate. Presumably as a direct result of that, on 9/9/2025 Kelly from Blue Shield called Brown and Toland and sent them the $34.94 claim asking them to review it. (Again, as it turns out, as they just had reviewed it on 8/29/2025).

“So what happened?” I asked today.

My rep told me that whomever at Brown and Toland spoke to Kelly on 9/9/2025 didn’t get or didn’t put in correctly the claim reference number, and so when they passed it on to the adjuster in the benefits department it couldn’t be worked on, and so nothing happened since then. So much for their 30 day investigation!

However my nice rep today told me the results of the 8/29/2025 benefits analysis which as previously mentioned was that when Labcorp got this claim submitted it was NOT coded as preventative. So the solution is that One Medical needs to change the diagnosis or CPT codes and resubmit the corrected order at Labcorp so that Labcorp can bill Brown and Toland for these as preventative services, and presumably get its $34.95 directly from them. As of now, that’s it.

I am of course girding my loins and preparing to ask One Medical to re-submit that lab claim with the preventative codes.

Meanwhile, I mentioned to my nice rep that I had two subsequent tests that I was not billed for. One was a Fit test in which One Medical sent me home with a kit to scoop my poop. That seems definitely to be preventative as it was to test for colon cancer. The other was a set of tests for low iron ordered during my preventative care visit because my iron levels looked a little low. My guess is that doesn’t fit the preventative category and I should have paid for that.

You may recall that iron test was billed at $0 and neither me nor the Labcorp rep who was working the case with me quite understood why.

Turns out Brown and Toland think that I should have paid a co-pay for both of those tests. The Fit test billed on 5/18/25 was $15.60 (1537124). By the way, Brown and Toland is getting a good deal as the cash price Labcorp charges consumers for that is about $90! The iron test was billed at $60.79.

You’ll recall my lab copay is $50, so Labcorp should have been charged me the lower of the copay or the actual total. Which is $15.60 for the Fit test and $50 for the iron test.

I got no charge for either.

By the way, I would like to show you the EOB from Blue Shield, but as they cancelled and reinstated my insurance last month, their online site has wiped all my EOBs!

So I agreed with the Brown and Toland rep when she suggested that they investigate the $15.60 bill for the Fit test to see if there should be a co pay, and I may hear from them in 30-45 business days.

And just to square the circle I will (probably) ask One Medical to resubmit the claim!

And yes this is all totally ridiculous and it all indicates why health care is so overly complex and why no consumer can figure out what is going on.

CODA: Meanwhile I was contacted by a journalist asking about ChatGPT being used to to sort out and protest medical bills. So I went down that rabbit hole a little too.

Matthew Holt is the founder and publisher of THCB